As Bitcoin recently surged past the $64,000 mark, reminiscent of its 2021 peak, the specter of a crypto bubble looms large once again. But what exactly is a crypto bubble, and how does it operate? In this article, we dissect the intricacies of crypto bubbles, examine their historical context, and outline warning signs for investors.

Defining Crypto Bubbles

Crypto bubbles denote frenzied surges in cryptocurrency prices driven by hype and speculation, often exceeding their intrinsic value. Unlike traditional assets, cryptocurrencies lack tangible assets or revenue streams, rendering their valuation speculative and vulnerable to market sentiment.

Parallels with Traditional Bubbles

Crypto bubbles share striking similarities with traditional financial bubbles, such as the dot-com bubble of the late 1990s or the housing bubble in 2008. Both are characterized by exuberance, euphoria, and a fear of missing out (FOMO) driving prices to unsustainable levels.

How Crypto Bubbles Work

Initial Hype and Adoption: A new cryptocurrency or blockchain project garners attention, leading to an influx of investment from early adopters attracted by its potential utility or disruptive features.

Speculative Investment: As awareness grows, speculative investors enter the market, hoping to capitalize on rising prices, further driving up demand and creating a feedback loop.

Media Attention and FOMO: Mainstream media coverage and social media influencers amplify the hype, attracting more investors driven by fear of missing out on potential gains.

Irrational Exuberance: Prices skyrocket to unsustainable levels, fueled by greed and disregard for fundamental analysis, as investors chase quick profits.

Peak and Correction: The bubble peaks as buying pressure wanes or negative news emerges, leading early investors to sell, triggering a sell-off and a subsequent price decline.

Bubble Burst: Prices collapse dramatically, wiping out investor wealth, often triggered by regulatory crackdowns, security breaches, or loss of market confidence.

Recovery and Consolidation: Surviving projects with strong fundamentals may stabilize at lower levels, while weaker or fraudulent projects fade away.

Examples of Past Crypto Bubbles

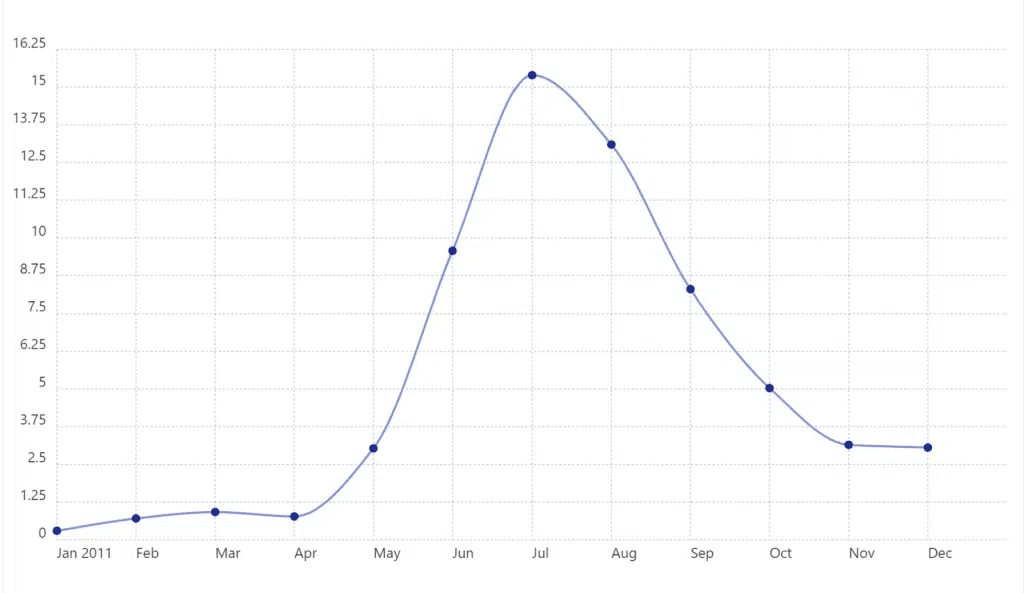

2011 Bitcoin Bubble: Bitcoin’s price surged to around $30 before crashing, resulting in significant losses for early investors.

2017 Bitcoin Bubble: BTC soared to nearly $20,000 before crashing to around $3,000 within a year.

2018 Altcoin Bubble: Alternative cryptocurrencies reached all-time highs before losing significant market value.

2021 NFT Bubble: Non-fungible tokens gained widespread attention, with some selling for millions of dollars, before trading volume plummeted in 2022.

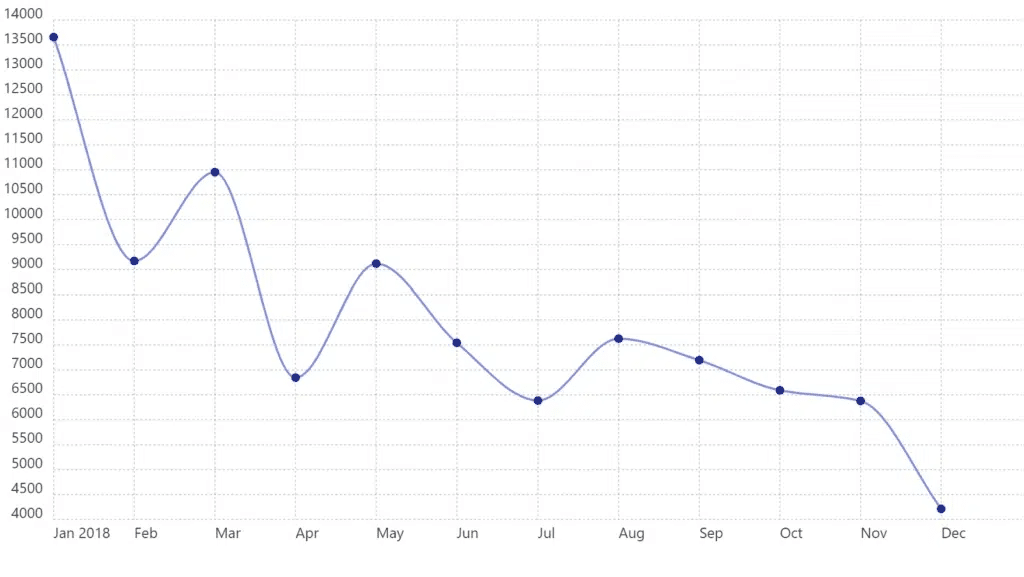

2022 Bitcoin Bubble: Bitcoin surged to an all-time high of over $68,000 before undergoing a significant correction.

Warning Signs for Crypto Bubbles

Rapid Price Surge: Sudden and steep price increases over a short period may signal a brewing bubble.

Hype and Media Attention: Dominance of a cryptocurrency in media coverage accompanied by rapid price hikes could indicate a bubble.

Volatility and Trading Volume: Wild price swings and high trading volumes suggest speculative trading and market instability.

Market Capitalization: Unrealistic market valuations compared to adoption and utility may signal an overheated market.

Fear and Greed Index: Extreme readings on sentiment indicators reflect irrational market behavior driven by optimism or pessimism.

Increased Margin Trading: Rising levels of leverage amplify gains and losses, indicating heightened speculation.

Strategies for Investors

Reduce Exposure: Consider selling off some holdings when signs of a bubble emerge.

Monitor the Market: Stay informed about news and trends to make informed decisions.

Seek Expert Advice: Consult experienced traders or financial advisors for guidance.

Think Long-Term: Adopt a long-term mindset and focus on fundamentals rather than short-term gains.

Implement Stop-Loss Orders: Set up orders to automatically sell assets if prices dip below a certain threshold.

Stay Disciplined: Stick to your investment strategy and avoid emotional decision-making.

Conclusion

While crypto bubbles offer opportunities for quick gains, they also pose significant risks, including substantial losses. Understanding the dynamics of crypto bubbles, recognizing warning signs, and implementing prudent strategies are essential for investors navigating the volatile crypto market. By exercising caution, conducting thorough research, and maintaining discipline, investors can mitigate risks and potentially emerge stronger from market downturns.