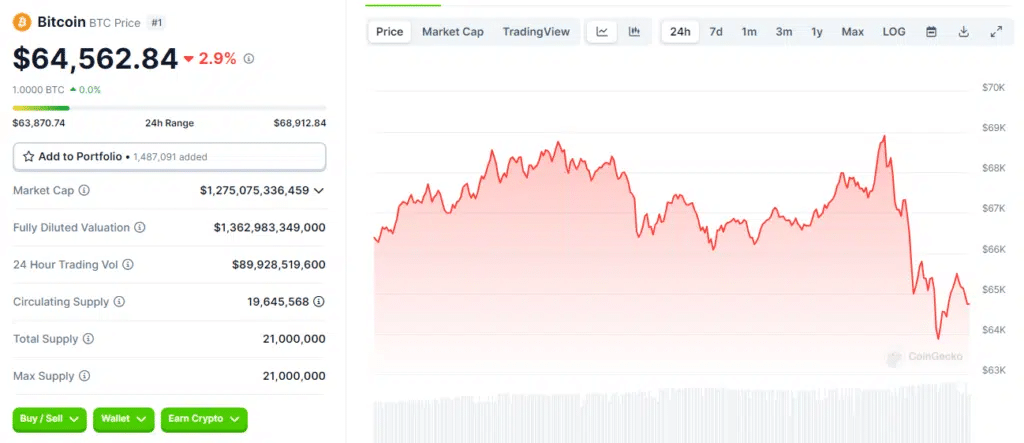

Bitcoin achieved a remarkable milestone today, soaring to its all-time high of $69,000. This surge, fueled by a rally of over 50% throughout February, marked Bitcoin’s highest price since November 2021, just ahead of the impending coin halving.

Immediate Profit Liquidation

However, as Bitcoin reached this historic peak, traders wasted no time in liquidating their profits, withdrawing a staggering $142 million in just one hour. Spot market data from Binance alone reflects this massive liquidation, indicating that short-term traders were quick to cash in amidst fears of a potential correction. The market’s consistent rally over the past two weeks likely fueled these concerns.

Price Correction and Market Impact

Following the profit liquidation, Bitcoin experienced a nearly 5% drop in just an hour, currently trading below $65,000. This sharp correction highlights the inherent volatility of the cryptocurrency market, where sentiment shifts can lead to rapid price fluctuations.

Broader Market Trends

The profit liquidation wasn’t limited to Bitcoin alone, as the broader crypto market saw over $720 million liquidated since Bitcoin hit its peak. Ethereum, the second-largest cryptocurrency, also witnessed a decline, dropping to $3,600 from its earlier peak of over $3,800.

Impact on Memecoins

Memecoins, a category of cryptocurrencies known for their speculative nature, suffered significant losses amidst the profit liquidation. Leading tokens like BONK, Dogwifhat (WIF), and FLOKI experienced declines of over 15% since yesterday. These meme tokens had seen substantial rallies in recent months, surging over 100% in just a week, making them particularly susceptible to sharp corrections.

Conclusion

The rapid liquidation of profits following Bitcoin’s all-time high underscores the dynamic nature of the cryptocurrency market. While Bitcoin’s milestone was cause for celebration among investors, it also served as a reminder of the market’s inherent volatility and the importance of risk management in navigating these fluctuations.

Henify Magazine